- Section Heading

Valued Shareholders,

Welcome to the Monogram Technologies shareholder Frequently Asked Questions (FAQ) page.

If you have any questions, please email monogram@equitystock.com. All emails will be answered in the order they are received and within 1-2 business days.

- Section Heading

Frequently Asked Questions

Q: What do I do if I cannot locate my Proxy Voting Code?

A: Please note that we sent all voting control codes to the email address on record on September 2. If you don't see it in your inbox, please check your Spam or Junk folders. Otherwise, please contact the Proxy solicitor, Okapi Partners LLC, toll-free at +1 (888) 785-6673 or info@okapipartners.com to help you vote the shares.

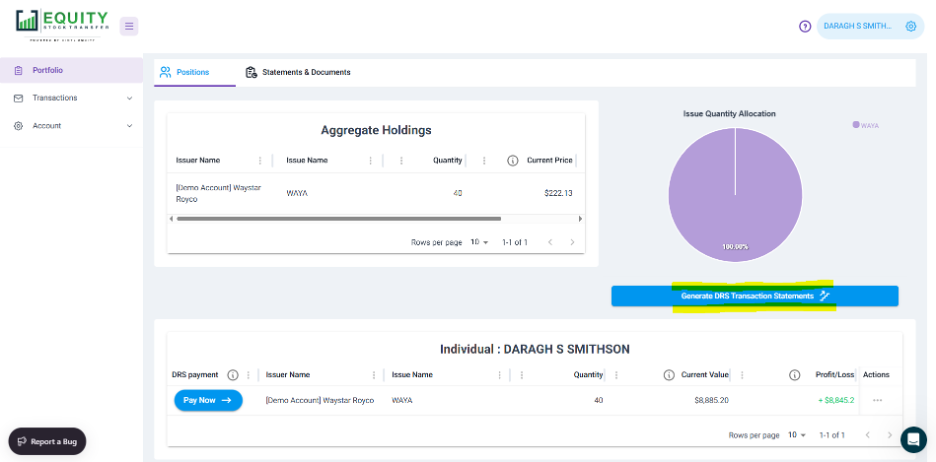

How do I view my account at Equity Stock Transfer?

Go to my.equitystock.com and log in using the email you used to buy your shares. No username or password is needed.

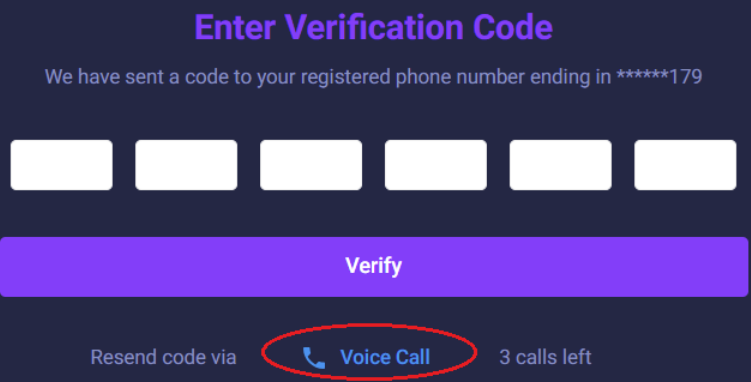

I'M NOT RECEIVING THE TEXT CODE or ACCESS DENIED message.

If you are not receiving the text with the numeric code, click on VOICE CALL. You will receive a call on your landline or other phone of your choice, with an electronic voice verbally speaking the 6-digit code.

IS YOUR EMAIL NOT BEING RECOGNIZED saying ACCESS DENIED?

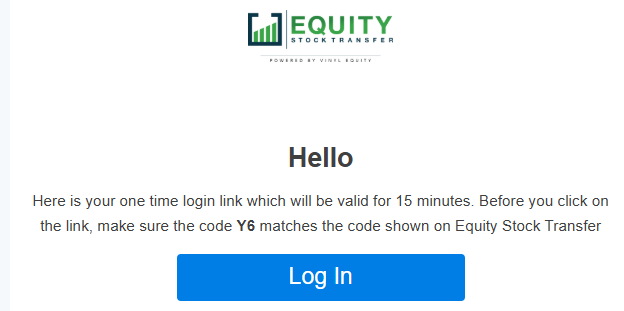

When browsing to my.equitystock.com, you must enter the same email you used when buying your shares. (No username or password is needed.)

A login email will then be sent from noreply@equitystock.com with the subject “Login to Equity Stock Transfer”. Open this secure email from us, and click the large blue LOG IN button with white lettering.

How do I correct incorrect personal information on record?

How to fix a wrong social security number:

Please complete and sign this W-9 form and provide it to the transfer agent so they can update your information in the share register. Form: https://www.irs.gov/pub/irs-pdf/fw9.pdf.

Email the form to the transfer agent at info@equitystock.com.

How to fix a wrong email address, mailing address, or phone number:

Please send an email to info@equitystock.com with the corrected information.

Be sure to include the full name, email address, and mailing address currently on the account so we can validate it.

You must send this from the email address we have on file for your account.

How to fix the spelling of your name:

Please email info@equitystock.com a photo of your driver's license or passport which displays the correct spelling of your name.

How to fix a trust registration or date:

Please email info@equitystock.com a copy of the first and last pages of the trust agreement.

Please send this email from the email address which is on file for your account.

What is the DTC number for Equity Stock Transfer?

7925